rhode island income tax rate

Tax rate of 375 on the first 68200 of taxable income. Exact tax amount may vary for different items.

Will Mississippi Join The No Income Tax Club International Liberty

Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now.

. There are no local city or county sales taxes so that rate is the same everywhere in the state. For more information about the income tax in these states visit the Rhode Island and New York income tax. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

Effective tax rate 385. Interest Rates Delinquencies and Overpayments 2022. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Rhode Island.

Detailed Rhode Island state income tax rates and brackets are available on. Rhode Island state tax 2693. Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. If you make 150000 a year living in the region of Rhode Island USA you will be taxed 35197. Detailed Rhode Island state income tax rates and brackets are available on.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum. The tax applies to the sale lease or rental of most. Any sales tax that is collected belongs to the state and.

Tax rate of 475 on taxable income between 68201 and 155050. Income Tax Brackets Rates Income Ranges and Estimated Taxes Due. Detailed Rhode Island state income tax rates and brackets are available.

Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 17 2023. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. This tool compares the tax brackets for single individuals in each state.

To calculate the Rhode Island taxable income the statute starts with Federal taxable. Groceries clothing and prescription drugs. Marginal tax rate 475.

Complete Edit or Print Tax Forms Instantly. The rate so set will be in effect. Each marginal rate only applies to.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Taxable Income line 7 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 RHODE ISLAND TAX. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

Ad Access Tax Forms. Total income tax -11081. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income.

Rhode Island also has a 700 percent corporate income tax rate. The sales tax rate in Rhode Island is 7. Here you can find how your Rhode Island based income is taxed at different rates within the given tax brackets.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. This tool compares the tax brackets for single individuals in each state. Tax rate of 599 on taxable income over.

For more information about the income tax in these states visit the Connecticut and Rhode Island income tax. The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum.

Rhode Island Sales Tax Rate Table Woosalestax Com

Ri 1040xamended Rhode Island Individual Income Tax Return 2010

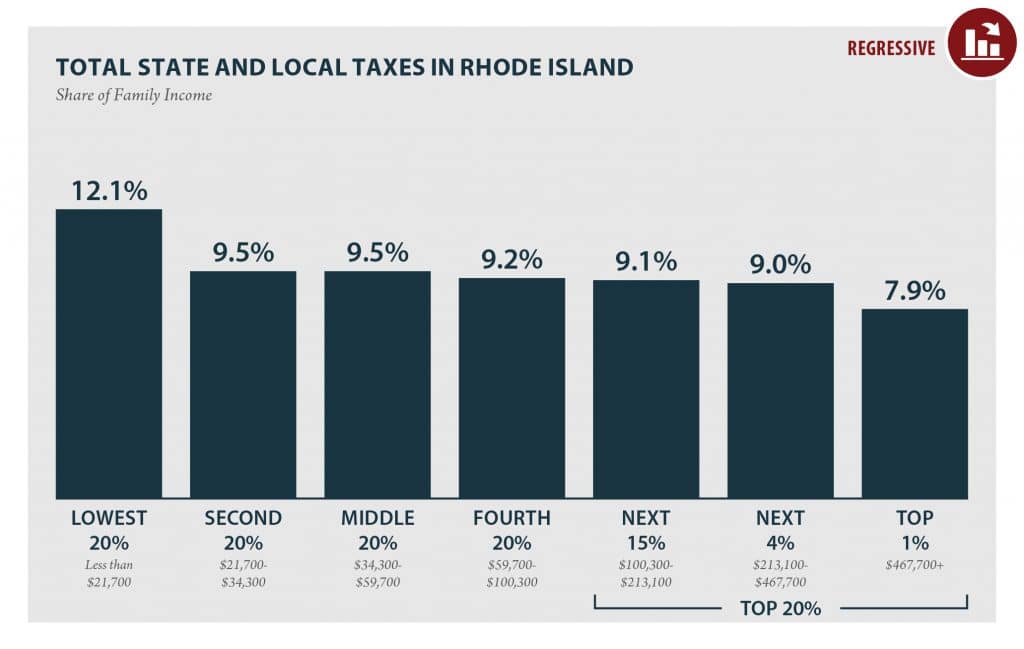

Raising Revenues To Invest In Rhode Island Economic Progress Institute

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

State Income Tax Rates And Brackets 2021 Tax Foundation

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Rhode Island Sales Tax Small Business Guide Truic

Here S How Your State Measures Up On Taxes The Motley Fool

Rhode Island Vehicle Sales Tax Fees Calculator Find The Best Car Price

Fiduciary Income Tax Forms Rhode Island Division Of Taxation Fill Out And Sign Printable Pdf Template Signnow

Top Personal Income Tax Pit Rates In The 50 States In 2004 And 2005 Download Table

Monday Map Top State Income Tax Rates Tax Foundation

Greater Providence Chamber Of Commerce Our Top 10 Reasons Why Now S Not The Time For A 50 Tax Hike On Rhode Islanders Any Increase In Personal Income Tax Rates Would Adversely

Rhode Island Sales Tax Information Sales Tax Rates And Deadlines

Rhode Island Eliminates Car Tax In Revised Budget Proposal Wjar