how much will my credit score increase with a car loan

Answered on Dec 15 2021. Increase your credit score.

When you make payments on time it displays.

/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

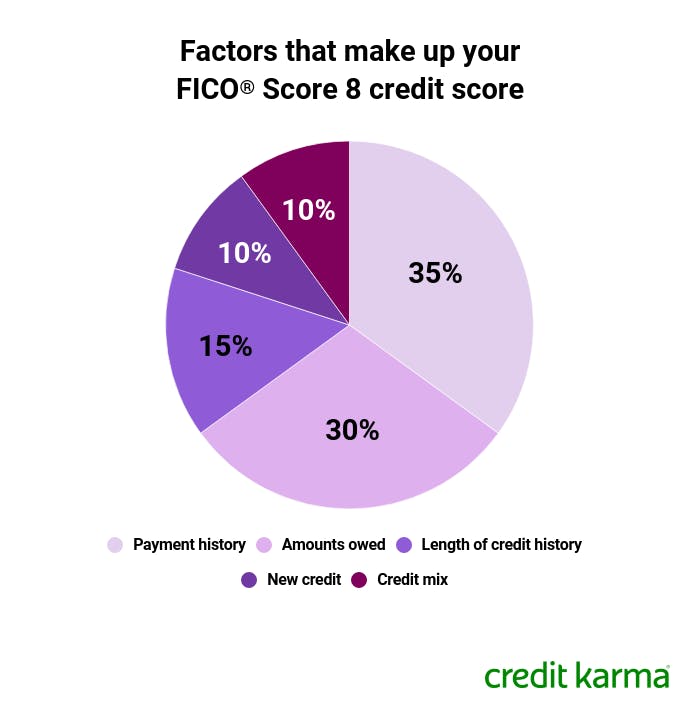

. Your credit score directly affects how much interest youll be paying on any loan and credit report discrepancies play a major role in interest. Generally speaking when you pay off a car loan or lease your credit score will take a mild hit. Your payment history makes up a very large portion of your credit mix.

In a nutshell the FICO credit scoring formula the most commonly used scoring. Here is how its calculated. Granted this method will make the auto loan drag on longer but at least.

Because a portion of your credit score is derived from credit mix getting a car loan may help your credit profile if you dont already have an installment loan. Paying off a car loan can allow more breathing space by reducing your. However its normally temporary if your credit history is in decent shape it bounces back.

According to a study done by AAA the average auto repair loan falls between 500 and 600. As you make on-time loan payments an auto loan will improve your credit score. How much your credit score will increase is determined by your starting point.

By CreditNinja October 17 2022. Average interest rate for used car loans. Throughout your life you build a credit score which can change over time.

It represents your creditworthiness and the likelihood that you will repay your. Unfortunately when you first pay off your car your credit score will slightly go down and will not increase. Lenders usually decide upon loan approval based on your credit score.

In the event of a financial setback refinancing will reduce monthly auto loan payments. The impacts of a car loan start with the first inquiry on your credit score. When you visit a dealer and decide to purchase a car fill out the loan paperwork and give the dealer permission.

That being said missed personal loan payments also reflect on your credit report the same. Average interest rate for new car loans. Youre not alonemany people with car loans question when to pay it off.

How much your credit score will increase is determined by your starting point. It might be a simple five-step one such as Excellent Good Fair Poor and Bad. If you make payments on time your credit score will grow.

If a payment is late its recorded as 30 60 90 or 120 days late. From my own experience paying off several auto loans whenever I paid. If you already have a credit score in the 800s and you make payments on a car loan it wont increase much.

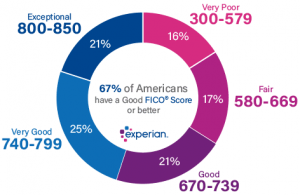

Unfortunately about one in three drivers are. While many factors come into play when calculating your FICO credit score you may start to see your auto loan raise your credit score. Your credit score is a number between 300 and 850 on the FICO scale which is the most commonly used credit scoring model used by auto lenders.

Your score will increase as it satisfies all of the factors the. If you have a five-year car. There are five factors that.

If you already have a credit score in. The good news is financing a car will build credit. How applying for a new auto loan will impact your credit score.

The car loan remains on your credit for the life of the loan plus another 10 years. A credit score refers to the Credit Tip-Off Service CTOS score that ranges between 300 and 850. In recent analyses of consumer credit behavior Experian has been using these tiers.

A lot of new credit can hurt your credit score. Once you pay off a car loan you may actually see a small drop in your credit score. High Interest Rate If you have a lengthy auto loan 60 70 or 80 months and youre paying a very high interest rate you may want to consider paying off your loan because you.

A personal loan stays on your credit history just like credit card debt or a car loan.

What S The Minimum Credit Score For A Car Loan Credit Karma

Will Paying Off My Car Loan Increase My Credit Score

What S The Minimum Credit Score For A Car Loan Credit Karma

How Fast Will A Car Loan Raise My Credit Score Auto Credit Express

Why Did My Credit Score Drop After Paying Off Debt Nerdwallet

Does A Car Loan Help My Credit Score Nerdwallet

Can I Get A Car Loan With A 600 Credit Score Experian

What Credit Score Is Needed To Buy A Car Lendingtree

How To Get A Bad Credit Car Loan Mtn View Chevrolet Chattanooga

How To Improve Your Credit Score With A Personal Loan Bankrate

11 Tips For Improving Your Credit Score To Get A Loan

Will Financing A Car Increase My Credit Score Sell Your Car To Offermore Of Pinellas To Maximize Buy Power

How Fast Will A Car Loan Raise My Credit Score Plus The Secret To Rate Shopping

What Happens If I Pay My Car Loan Off Early Bankrate

How Do Car Loans Affect My Credit Score Capital One Auto Navigator

Which Credit Score Is Used For Car Loans Experian